Should retired investors have exposure to equity?

Mr. Arora retired yesterday from a construction company after 35 years of working. At the time of retirement, he received retirement benefits from his company and has some savings accumulated for the purpose of retirement. The big question he is facing is “Where should I invest my money which allows monthly withdrawal and some amount of appreciation?” By nature, he is a risk averse investor and favors investing in a deposit. One of his friends suggested him to invest in a Monthly Income Plan (MIP), a hybrid mutual fund which invests in Debt (70-85%) and Equity (15-30%). Mr. Arora’s thought is, should I invest in equity?

The perception is retired investors should stay away from investing in risky assets and should always look at investment options that generate regular income only. This perception holds good to a certain extent. But the bigger challenge is inflation; while inflation is robbing away your purchasing power, the monthly expenses spent by the retired investor increases as years pass by. Imagine a scenario, where an individual has limited corpus, increasing expenses (including medical expenses) and no addition to the existing corpus during retirement period. In such case, the bigger challenge could be depleting retirement corpus and outliving it. “What would happen if the corpus gets over and I live longer?”

Let’s take the example from the leaping frog story where a frog while leaping around keeps falling into a well. While trying to get out of the well, he starts climbing the slippery wall. The frog jumps 3 feet and slips 2 feet, so effectively it has climbed 1 foot. Instead of slipping 2 feet, if it falls back into the water it would have lost the entire climb it had gained.

Same applies to the corpus meant for retirement. On one side the investor would gain through investment returns and on the other side he would start withdrawing from the corpus. When withdrawals become higher than the investment gains, there can be 2 scenarios:

Scenario 1:

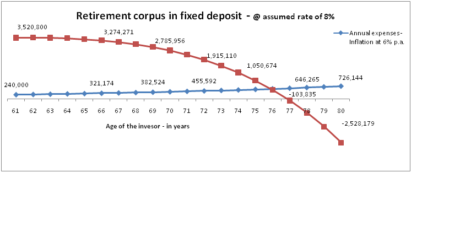

Let’s look at a scenario when an investor retires with a corpus for Rs. 35 Lakhs and invests his entire retirement corpus in a bank deposit. He starts withdrawingRs. 240,000/- p.a. to meet his expenditure and to manage the inflation and his withdrawal increases by 6% every year.

When one starts withdrawing from the corpus and the interest earning is lower, he starts eating in to the principal amount and it starts depleting from the very beginning. As the expenses/withdrawal increases over years, the depletion increases at an accelerated rate and by the time investor turns 77 the corpus is in negative zone. The challenge is what if the investor lives beyond 77years?

Scenario 2:

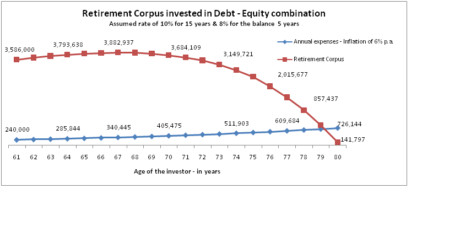

Same investor with Rs. 35 Lakhs of retirement corpus and Rs.240,000/- annual withdrawal to begin with (increasing at 6% p.a. because of inflation) chooses to invest in a combination of Debt (70-85%) and Equity (15-30%) for the first 15 years of retirement and balance 5 years in complete Debt (100%) portfolio. Since we are looking at a time horizon of 15 years (i.e. from the age of 60 – 75 years of retirement phase), investing in equity would have sufficient time to accumulate the wealth.

In such case, the retirement corpus would last till the investor turns 80 years. So a small exposure to equity in the retirement corpus would help in building the buffer.

One option an investor could look at is investing in Debt funds/deposits and Equity mutual funds separately. Ideally the equity mutual fund should be either Index funds or Large Cap funds, where the risk is lowest amongst all the equity mutual funds.

The other option is to invest in hybrid mutual fund products like Monthly Income Plan (MIP). There are 2 variants in MIP, an aggressive MIP which has 30% exposure to Equity and conservative MIP which has 15% exposure Equity and the rest in Debt.

The basic thumb rule for Asset allocation is 100 minus Age (100-Age). For an individual who is just retired at the age of 60, he still could invest upto 40% in Equity and keep reducing the exposure to equity over time. So Equity exposure between 15-30% would help in building retirement corpus.

Created by Knowise Learning Academy India Pvt. Ltd.

Knowise is a Bangalore based firm that specializes in CFP (Certified Financial Planner) training and is an authorized education partner with FPSB

Add a Comment