Goal based financial planning

Vikas and Ram are colleagues in an IT firm who strongly believe in saving and investing. Both often discuss different investment offerings. Vikas is a strong believer of goal based investing whereas Ram’s focus is more on analyzing and comparing financial products to get optimal return. Ram believes that wealthcreation is more important as once you have money you are free to decide which goal you want to spend on. One day, Ram invites Vikas and his family home. This time Ram’s wife opens the discussion on Goal based financial planning. She requests Vikas to explain the importance of goal based financial planning.

Vikas explains Goal based financial planning as a focused process of investing toachieve Real Life Goals.Goal based financial planning does not work on “Do it and forget it” way. Here, the key is regular review of portfolio and goals.Vikas explains 5 benefits of goal based financial planning over product approach.

- Emotional and financial view point

Today every parent understands the need of higher education for their kids. Assume you are investing for your child’s higher education in a systematic way for a longer tenure. As the goal has emotional value, this investment would be the lastone to get disturbed during a financial crisis. Generally, goal based investments donot get disturbed for a longer period because of which they also attract the benefit of compounding. In this way,goal based financial planning has both emotional and financial view point.

- You would know how much to spend

It’s a myth that financial planning advises you to save, save and save. Very few people know that goal based financial planning can guide you to “Guilt Free Spending”. In financial planning, you can set aside money for your daily spending under budgeting section. The yearly outings and purchases can also be planned. If the spending’s are from an account earmarked for a particularspending, you would be more comfortable spending that compared to an unplanned spending. Most of the youngsters avoid financial planning as they consider it as more savings and no spending. Goal based financial planning believes that you “living life” today is as important as your comfort during your retirement.

- Will help plan future liabilities better

It is said that “compounding is the eighth wonder of the world, those who understand it earn it and those who don’t pay it”. While planning your goals, you can visualize the requirement of each goal and plan. This can help you reduce your future liabilities at least for the planned goals. Instead of taking loans in future you would now start saving for the same. Its always better to invest for your goals and earn profits than take loan and pay interest. When you plan your goals in advance you can save less and achieve more. Totally goals can reduce liabilities by guiding you on how much you want to spend and how much you can afford to spend.

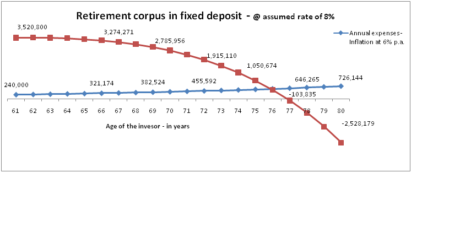

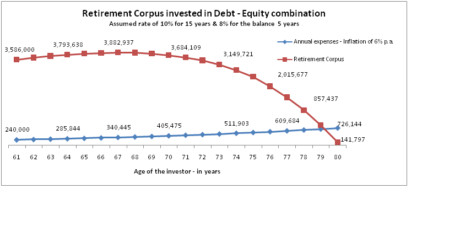

- Considers Inflation tenure, risk and return

Product side of investing focuses on getting highest return and goal based investing considers all the above and aims at risk adjusted return. Better combination of tenure and asset class can help us get optimal return from the portfolio. In asset classes like equity, the probability of loss reduces as the tenure increases. So, it is always wise to allocate riskier assets for longer goals. Short term goals can be managed by fixed income products.

- The key is to review periodically

Periodic review of portfolio and goals is the key. Life takes twists and turns that we don’t always see coming which is why it is important to review your financial situation. As change in your personal situation occurs, it is understandable that your goals may change. What can change over years is your situations, lifestyle, legislation, Taxation, Insurance needs, asset liability match and need for estate planning.

Created by Knowise Learning Academy India Pvt. Ltd.

Knowise is a Bangalore based firm that specializes in CFP (Certified Financial Planner) training and is an authorized education partner with FPSB